Hilltop Views Blog

Personal Finance 101: How to Save Money on Food (A Quick Guide That Doesn’t Involve Ramen Noodles)

When it comes to the “food” category of my budget, I’ve noticed that it’s easy for expenses to add up way faster than planned. To counteract that, I've implemented some strategies within the past year that have helped me cut down on my dining and grocery expenses while wasting less food and still getting to eat at my favorite restaurants.

Hilltop Market Update: 4th Quarter 2019

Chris Hostetler and Brittany Mollica summarize Hilltop’s updates on the economy and the markets from our latest quarterly investment review. We discuss slowing global growth, the chances of a coming recession and more.

5 Lessons in Happy Money

We’ve all heard the saying: “Money doesn’t buy happiness,” but what if using it wisely could bring you more satisfaction? That’s what Happy Money by Elizabeth Dunn and Michael Norton (2014) explores.

Smarter Charitable Giving – Should You Use a Donor Advised Fund?

With a little planning, there are still ways to benefit from a charitable deduction. One particularly useful strategy gaining popularity under the new tax law is gifting through a Donor Advised Fund (DAF).

Hilltop Market Update: 3rd Quarter 2019

Chris Hostetler and David Wise summarize Hilltop’s updates on the economy and the markets from our latest quarterly investment review. We discuss recent market volatility, the trade war, and more.

Personal Finance 101: Do You Really Need Disability Insurance?

For most people, dying is a more visceral fear, so we tend to focus our anxiety and worry on the possibility of death. But facing a period of disability without the proper insurance in place is a serious risk. If you lose income because you’re too sick or injured to work, the financial cost to you and your family can be devastating.

Hilltop Market Update: 2nd Quarter 2019

Rusty Eriksen and David Wise summarize Hilltop's updates on the equity and income markets, including thoughts on recent conversations with clients.

A Legacy More Valuable Than Money – Your Ethical Will

If you want to build a legacy that includes more than your personal and financial assets, the good news is you can easily send the right messages using an ethical will. Sometimes also called a “legacy letter”, an ethical will is any message that shares your personal values with your loved ones after you are gone.

Personal Finance 101: IRAs – Are You Team Traditional or Team Roth? Part Two

You’ve mastered the basic differences between a Traditional and a Roth IRA (by reading part one of this post) and you’re ready to start saving. Now, it’s game time: which type of account should you use? There’s no right or wrong answer, but there are a few items you should think through before making your decision.

Personal Finance 101: IRAs – Are You Team Traditional or Team Roth? Part One

You’re a saver, and you’ve heard that contributing to a Traditional or Roth IRA is a good tax move. But you may be bewildered about the difference and trying to decide which one is for you. We’re here to help! This post is part one of two and will discuss the rules of Traditional and Roth IRAs.

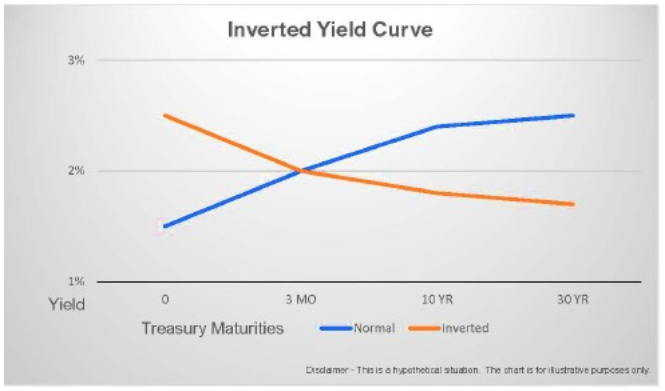

The Yield Curve Inverted – What Should I Do?

An inverted yield curve has a high correlation as a leading indicator for recessions. So far, the inversion lasted for only a few days; it could be just a blip, relatively meaningless. In fact, 10-year Treasuries have begun offering a higher yield already this week on optimism over a possible trade deal between the US and China.

Personal Finance 101: 5 Steps to Become the Boss of Your Budget

Budgeting does not have to be difficult or time-consuming. It can actually be comforting to know that you have a plan for your money, especially if that includes a regular Starbucks run!

Hilltop Market Update: 1st Quarter 2019

Chris Hostetler and Ben Yeager summarize Hilltop's updates on the equity and income markets, including thoughts on US economic strength, Brexit negotiations, US-China trade negotiations, the Fed's interest rate policy and more.